By Adil Khan

This article would briefly explain about the reporting capabilities in Fusion Financials Cloud. Let us look at the different reporting available:

1.General Ledger Standard reports

2. Account Monitor

3. Account Inspector

4. Financial Reporting Studio (FRS)

5. OTBI (Oracle Transactional Business Intelligent)

6. Smart View (Covered in Part 1 – Please refer ‘Reporting in Fusion Financials Cloud Part 1)

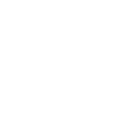

General Ledger Standard Reports –

Oracle General Ledger provides many seeded/pre-defined reports, which help the organizations to perform their day-to-day operations & reconciled the GL balances with Sub ledger applications. The reports cover Journal Entry Details, Trial Balances, Sub ledger the General Ledger Reconciliation Reports, Chart of Account Reports etc. The most widely used report is the Account Analysis Reports in different views that brings the detailed transactions in one format for the given parameters.

One can run these reports from Scheduled Processes work area. These reports can be extracted in multiple printable or analysable formats like HTML, CSV, PDF, Excel etc.

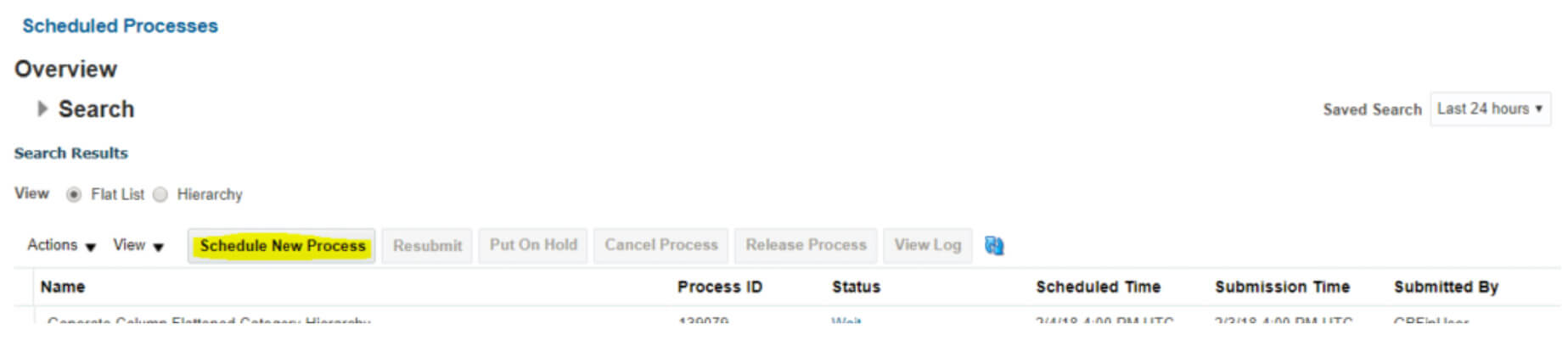

Account Monitor –

This tool gives the users separate place (GL Dashboard) to monitor the key account balances and activities on it. By creating the Account Groups, the user can setup the Account Monitor with default monitoring options. We can configure the comparisons (by time etc.); provide the thresholds, set up the tolerance limits and many more options to view the balances at General Ledger Dashboard. Business users can create multiple groups for the different accounts based on requirements. This can be changed easily at any point of time. Users can also click on the displayed balances and drill down at the detailed balances level to see the Journals and further to the source information (Sub ledger transactions). Here, users can see the real-time balances. The graphical representation of the balances can also be setup & seen on this page. The system applies the colors based on whether the changes are Good or Bad for the organization.

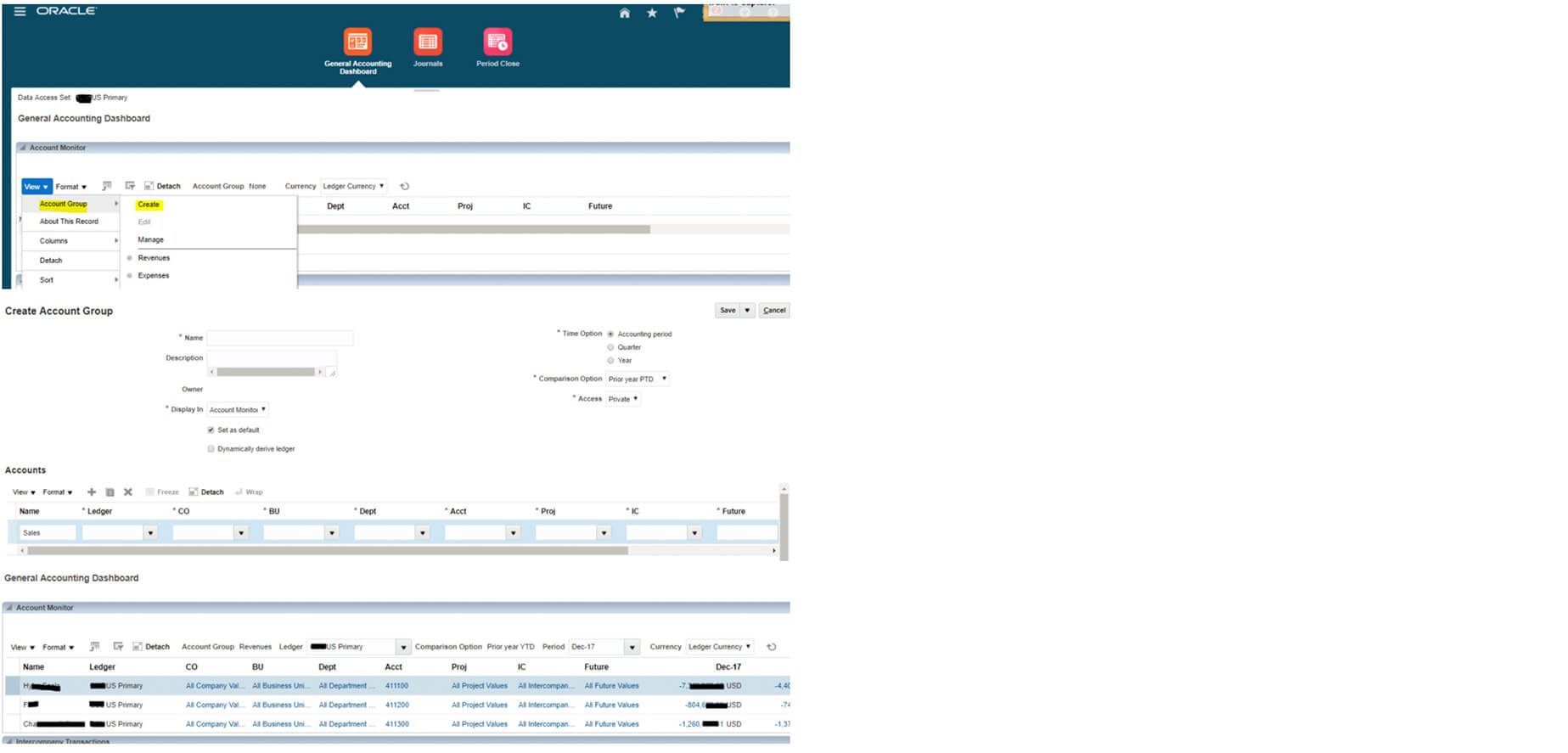

Account Inspector –

Account Inspector is the multi-dimensional analysis tool which helps to create the ad hoc pivot analysis, chart-based details and drill down from account to detailed transactions. You need to set up the report dimensions from Report & Analysis page from GL role.

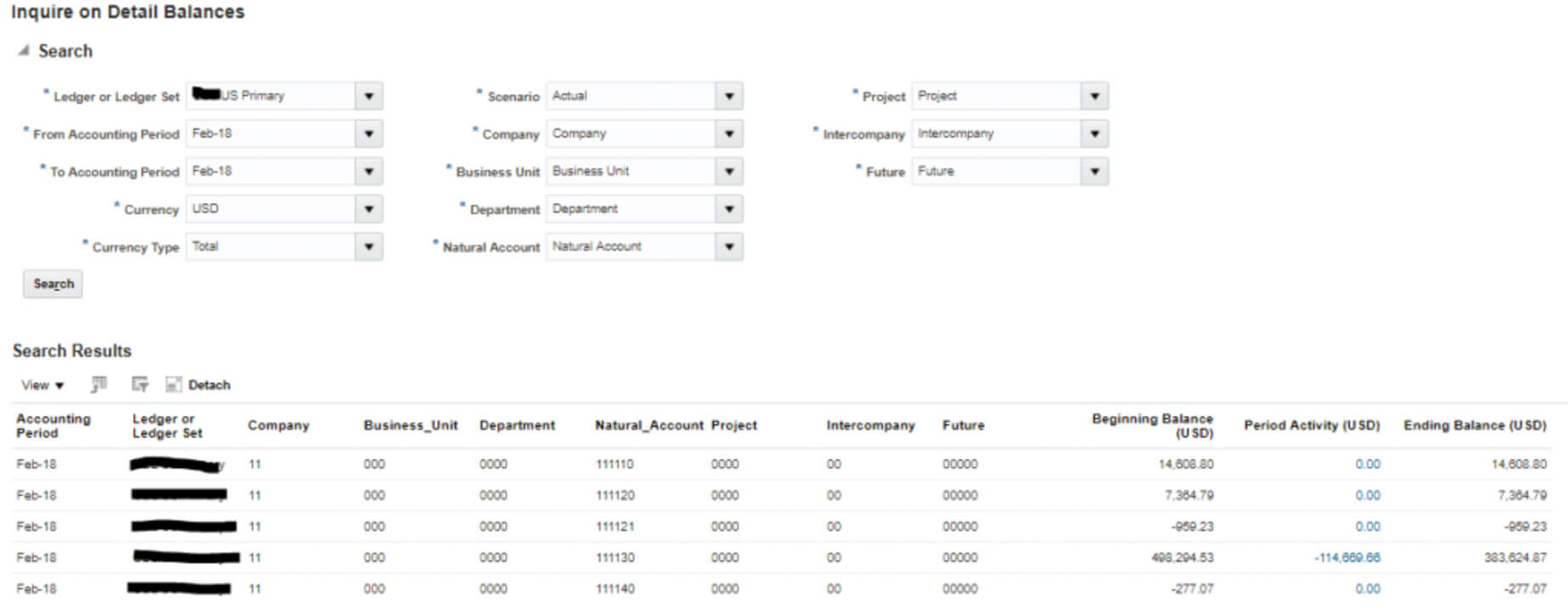

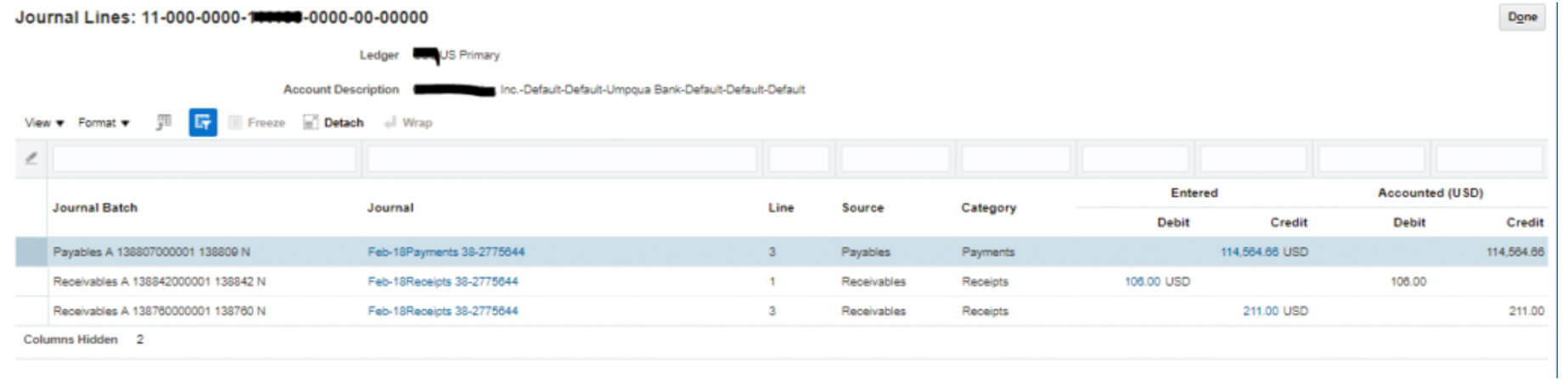

Detailed Balances:

GL Journal:

Financial Reporting Studio (FRS) –

This is the Oracle Hyperion Financial Reporting Studio also called FRS. Financial Reporting Center provides the facilities to build the financial reports on Oracle Fusion General Ledger balances. This tool mainly used to build the reportable financials statements like Income Statement, Balance Sheet, and Cash Flows. The reports can be seen in multiple output formats as PDF, Excel or HTML. An authorized user can open, publish or drill down through the report and understand the numbers and its origins. These reports are build using the given objects like Grids, Text Boxes, Account Hierarchies, Images/Charts and many other formatting & formulas.

To build the FR reports –

1. Install and configure Financials Reporting Studio

2. Configure the Workspace connection

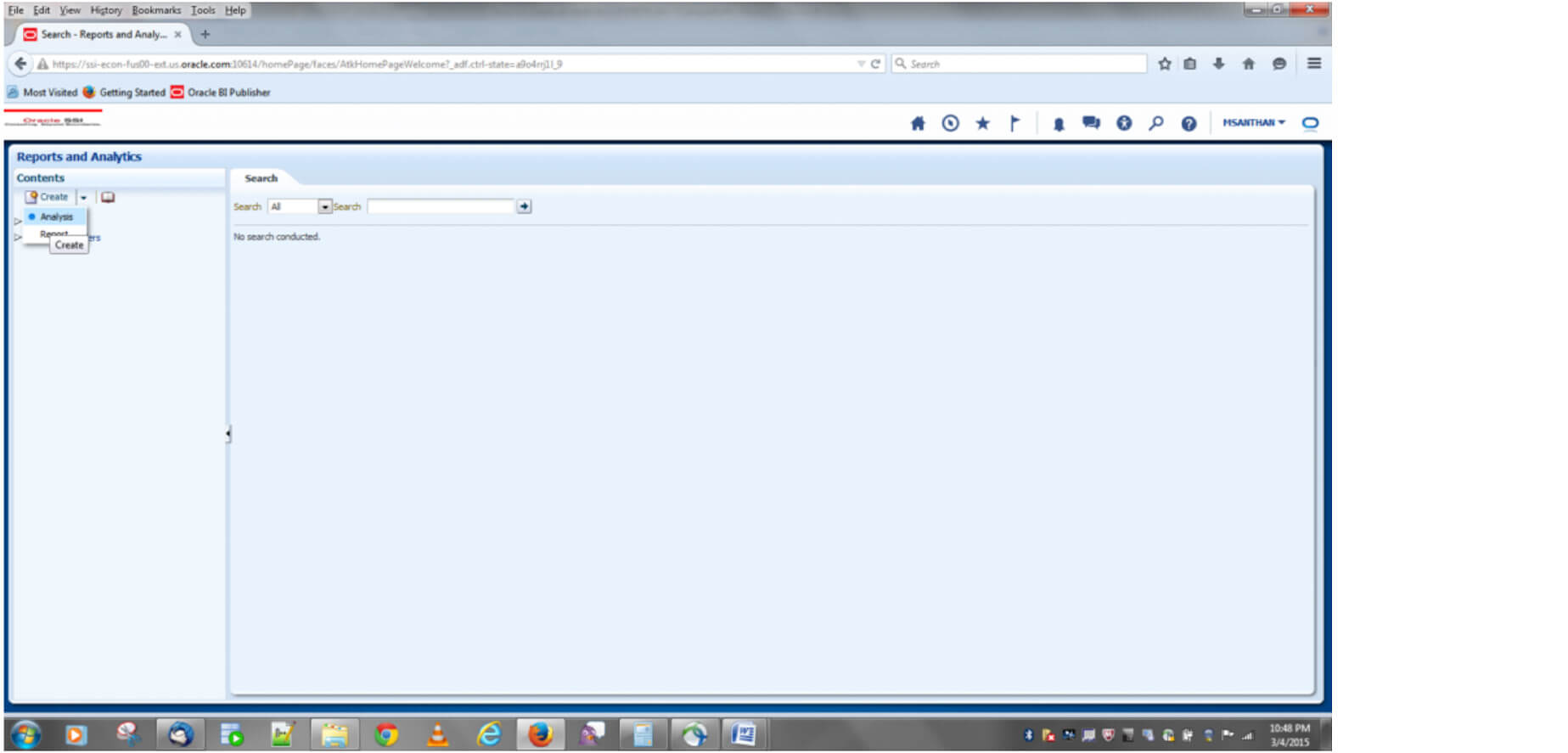

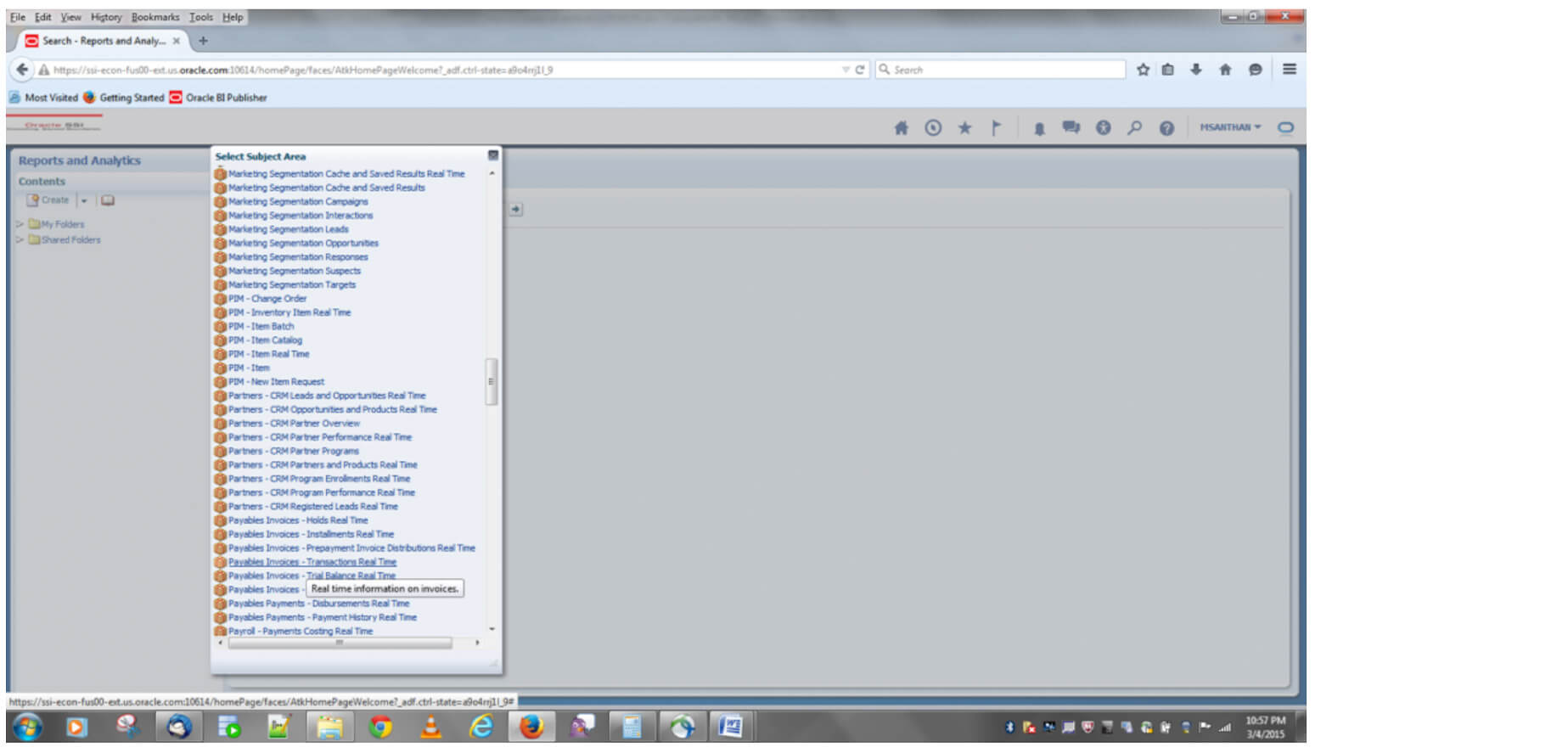

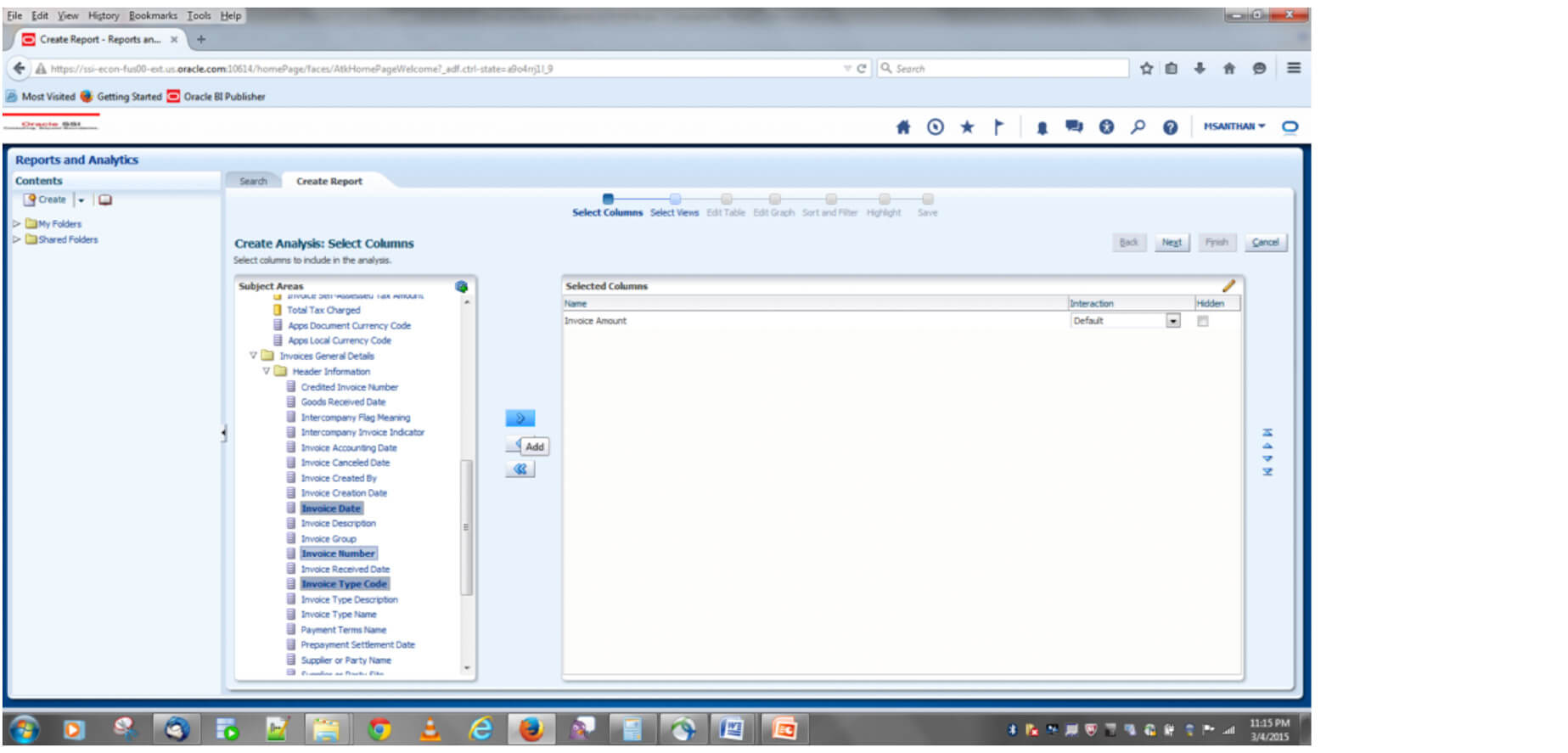

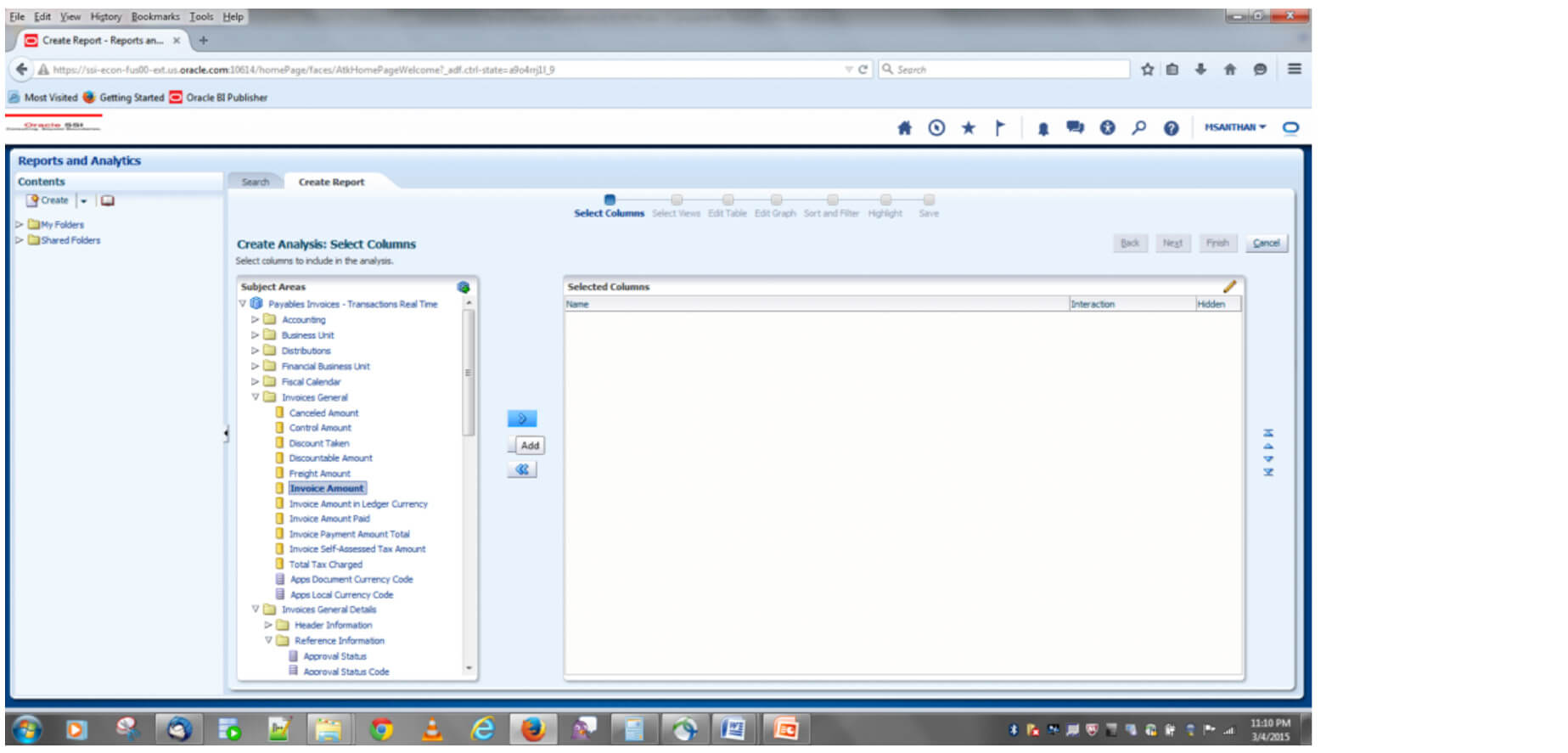

OTBI (Oracle Transactional Business Intelligent) – Financials

The Oracle Transactional Business Intelligent is called OTBI, which give users to create their own ad hoc analysis quickly using the Oracle views access. This is the simple drag and drop reports/analysis based on the relevant subject areas (AP, AR etc.) The user can select the required subject areas, columns, apply formatting like a filter, charts, colors etc. and create the analysis/reports. There are few-seeded OTBI reports comes with the financial package.

About the Author

Adil Khan is the Oracle Financials Cloud Certified Consultant with an experience of 9+ years including both EBS and Financial Cloud. He was involved in many full life-cycle implementations, project management, pre-sales and support roles to stabilize the application. He is qualified MBA Finance and Pursuing Certified Management Accountant (CMA) from IMA, USA.