Solution Overview

Trinamix Investment Buy is an AI-powered solution designed to empower retailers with a range of functionalities tailored to enhance their operations. With utmost capabilities like inventory optimization and truck optimization, retailers can streamline their supply chain processes and ensure efficient resource utilization. Moreover, it facilitates faster purchasing decisions and supplier management, enabling retailers to respond swiftly to market demands and fluctuations. This ensures that retailers can capitalize on volume discounts and incentives, avoiding suboptimal practices.

Trinamix Investment Buy contextualizes data by incorporating historical, current, and predicted information, including commodity pricing trends. Its integrated workflows enable planners to simulate supply, demand, and inventory levels, allowing them to assess the impact on the supply chain in real-time. The platform breaks down various investment buying strategies, such as off-invoice deals, tiered pricing, and dynamic sourcing options, enabling planners to identify the most impactful avenues. By leveraging advanced algorithms, it recommends optimal investment strategies, guiding users on where and how much to invest to maximize efficiency and returns.

Furthermore, Trinamix Investment Buy empowers retailers to anticipate demand, optimize purchasing, and accurately predict prices, ultimately leading to cost reduction and revenue maximization. By embracing this innovative solution, retailers can achieve operational excellence, storage optimization, and overall efficiency, ensuring they stay ahead in today’s competitive retail landscape.

Background

In today’s dynamic retail landscape, staying ahead of the curve requires more than just intuition—it demands precision, insight, and strategic decision-making. Purchasing decisions are no longer just about acquiring goods; they are more about maximizing efficiency, optimizing returns, and navigating a plethora of variables that can make or break profitability.

Despite vendors offering volume discounts or incentives to spur product movement, many retailers miss out on these opportunities, leading to suboptimal practices. With products becoming increasingly commoditized, poorly managed inventory can also drive customers away, hurting satisfaction levels. In addition, this also involves a lot of capital and causes high warehouse maintenance and product obsolescence.

Trinamix Investment Buy steps in to tackle these challenges head-on by conducting thorough analyses and offering tailored recommendations for purchasing decisions, helping retailers make informed decisions while maximizing efficiency.

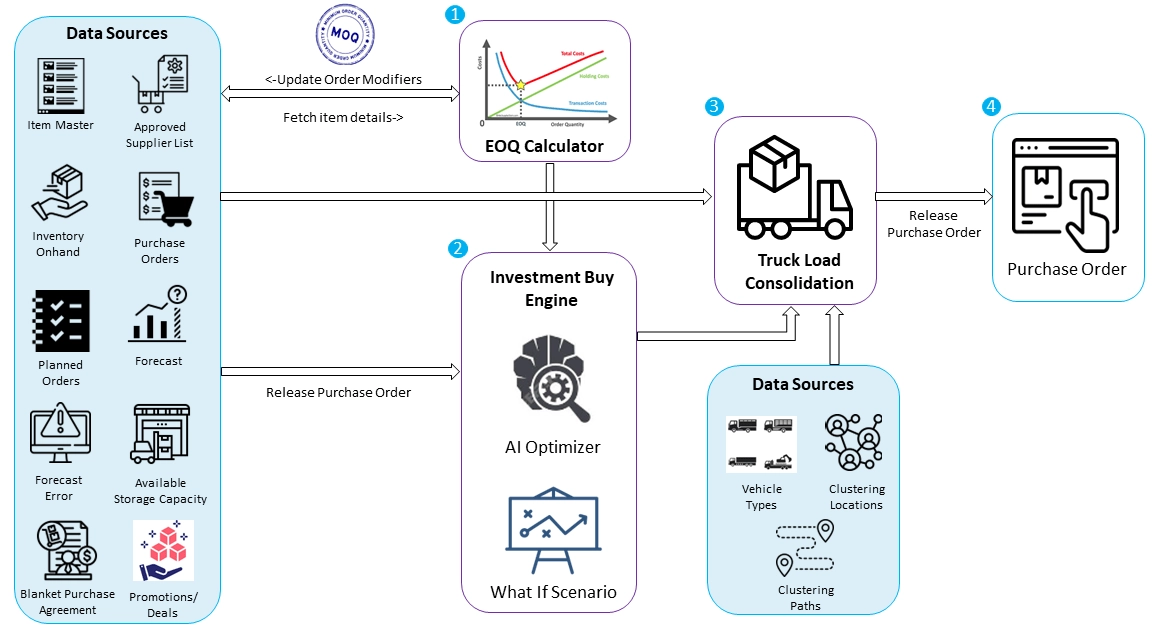

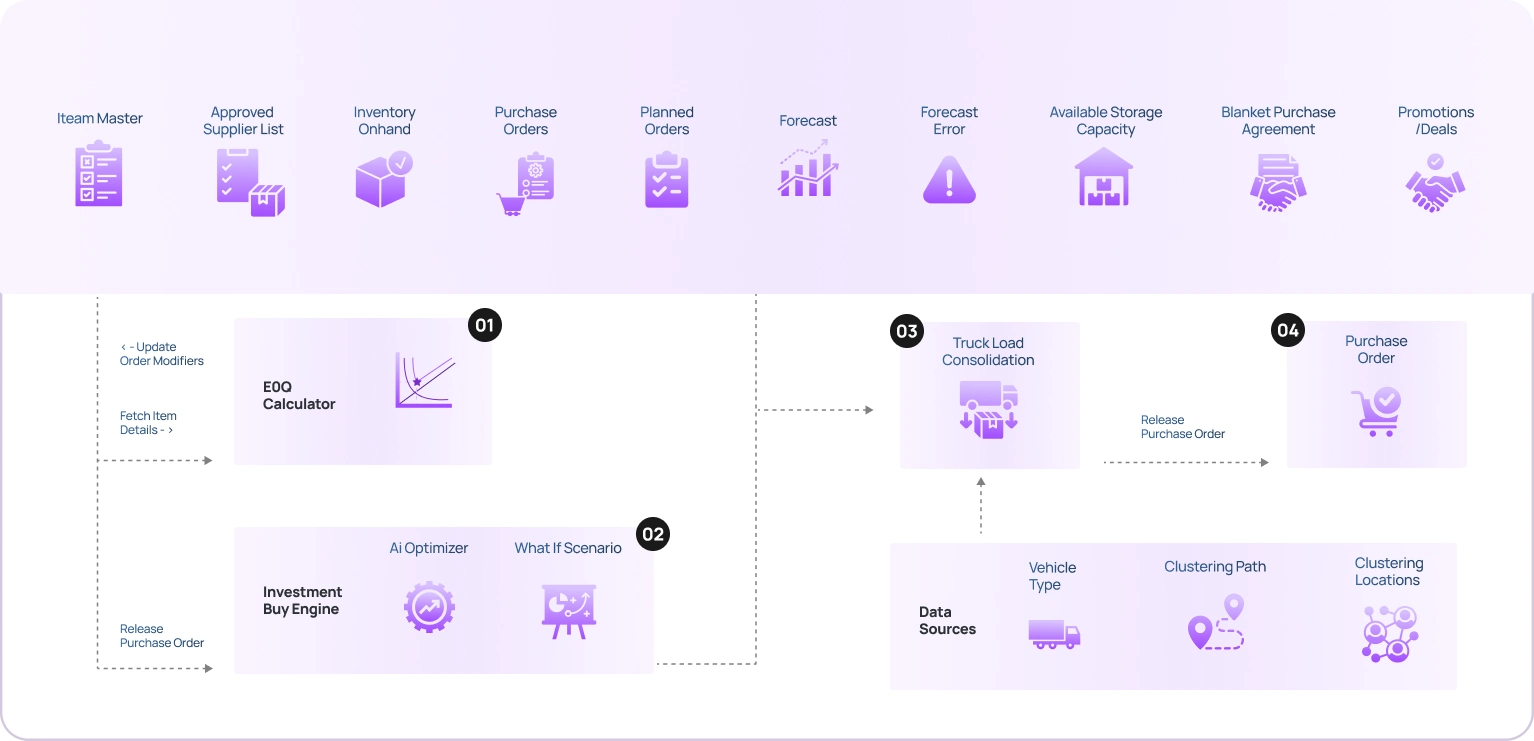

Trinamix Investment Buy – Process Flow

Success Stories

A leading beverage manufacturer in Europe—known for its wide portfolio of popular drinks—faced growing complexity in managing production schedules and meeting dynamic market demand.

A global packaging solutions provider partners with Trinamix to advance integrated planning to drive agility, efficiency, and cross-division alignment with the implementation of Oracle Cloud Planning modules and Trinamix AI-driven industry solutions.

Key Features

- Economic order quantity

- Buying – price prediction based on commodity price and cost models

- Buying optimization

- Vendor min-max

- Buying intelligence

- Recommended order modifiers

Key Benefits

Cost

reduction

Optimal investment strategies

Price prediction and buying optimization

Comprehensive opportunity view

Budget constraint alignment

Real-time data integration

Order modification suggestions

Storage

optimization

Market fluctuation mitigation

Predictive analytics

Customized recommendations

Scenario planning tools

Other Resources

The Rise of Intelligent Enterprises: Trinamix on Building Future-Ready Businesses

What was once emerging is now essential: Artificial intelligence is driving the next era of enterprise transformation. From predictive insights that anticipate market shifts to generative models that accelerate decision-making, AI is redefining how organizations operate and compete.

Trinamix Universal Web Scraper

Trinamix Universal Web Scraper is a GenAI-powered solution for intelligent data extraction, built for today’s fast-moving, data-hungry digital landscape.

Trinamix Price SenseAI

Trinamix Price Sense AI is an AI-driven solution for competitive pricing and promotion optimization, built for today’s fast-paced e-commerce landscape.

Trinamix AI Experience Lab

Trinamix Price Sense AI is an AI-driven solution for competitive pricing and promotion optimization, built for today’s fast-paced e-commerce landscape.

Frequently Asked Questions

What is Trinamix Investment Buy?

Trinamix Investment Buy is an AI-powered purchasing optimization solution that helps retailers make smarter, data-driven buying decisions. It analyzes multiple factors — such as shelf life, budget, storage, price trends, and supplier discounts — to recommend what, when, and how much to buy for maximum efficiency and profitability.

What challenges does Trinamix Investment Buy solve for retailers?

Retailers often struggle with overbuying, underutilized warehouse space, missed supplier discounts, and product obsolescence. Trinamix Investment Buy eliminates guesswork by evaluating all these constraints together, helping retailers strike the right balance between savings and practicality.

How does Trinamix Investment Buy help optimize purchasing decisions?

The solution uses advanced algorithms and predictive analytics to assess real-time data, forecast demand, and simulate various investment scenarios. It identifies the most profitable opportunities — such as when to buy in bulk, when to hold off, and how to maximize discounts without overstocking or wasting inventory.

What key features make Trinamix Investment Buy unique?

- Economic Order Quantity (EOQ) optimization

- Price Prediction using commodity cost models

- Buying Optimization across vendors and categories

- Vendor Min-Max Management

- Buying Intelligence for real-time decision-making

- Recommended Order Modifiers based on dynamic conditions

How does Trinamix Investment Buy use AI and predictive analytics?

AI models analyze historical, current, and forecasted data — including supplier offers, market trends, and commodity prices — to predict price changes and identify optimal purchase timings. Predictive analytics helps retailers proactively plan investments and avoid costly last-minute buying decisions.

Can Trinamix Investment Buy adapt to different product types and shelf lives?

Yes. The solution intelligently adjusts recommendations based on each product’s shelf life, turnover rate, and demand patterns. Whether it’s short-lived dairy products or longer-shelf-life items like flour, the system ensures purchases align with realistic sales and storage capabilities.

What real-world factors does Trinamix Investment Buy consider before recommending purchases?

It evaluates multiple real-time constraints, including:

- Shelf life and perishability

- Budget availability

- Warehouse/storage space

- Supplier discounts and price tiers

- Future demand forecasts

- Truckload optimization for logistics efficiency

What measurable benefits can retailers expect from Trinamix Investment Buy?

- Reduced costs through smarter purchasing

- Optimized inventory levels

- Higher ROI from supplier discounts

- Minimized waste and obsolescence

- Better budget allocation

- Improved supplier negotiation power

- Faster, more confident decision-making

How does Trinamix Investment Buy handle market fluctuations and supplier price changes?

The system continuously monitors commodity price trends and vendor offers to recommend the best timing for purchases. It can even suggest early buys before price hikes or strategic deferrals when prices are expected to drop — ensuring maximum cost efficiency.

Why should retailers choose Trinamix Investment Buy?

Because it goes beyond simple cost-cutting — it’s about buying smarter, not just cheaper. Trinamix Investment Buy empowers retailers to make informed, sustainable, and profitable purchase decisions by balancing real-world factors like budget, storage, and demand. It transforms purchasing from a reactive process into a strategic growth driver.